The Government of India has taken the initiative to provide affordable houses to all the economically weaker citizens. However, this concept of affordable housing is known to every part of the world, but in India, the need for affordable housing is massive with over 18 million houses to be made by 2020.

The Deputy Governor of RBI in 2007, Rakesh Mohan said that affordable housing is a critical element of national economic competitiveness. House is the place where the jobs go to sleep at night. The quantity, affordability, quality, and availability have a significant role to play into this. Proper housing to citizen has impacts on household wealth, health, education, employment, infrastructure and so on. As India plans to improve the housing condition of its citizens, the affordable housing becomes a mountain to climb due to many obstacles and limitations.

What Is Affordable Housing?

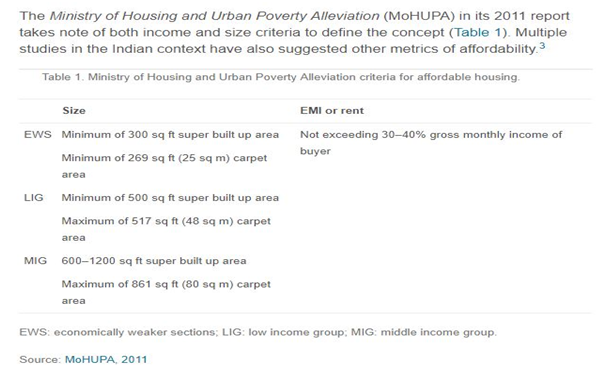

Before digging down to the facts and other factors and problems regarding affordable housing, we must know what the definition of affordable housing is? Internationally, there are many definitions of AH, and all of them are somehow related. In India, it refers to any method of accommodation that offers basic needs of a house but which meets some form of affordability criteria such as the income level of the family, affordability in the form of EMI size and the ration of the price of the house and the annual income of that family.

The Demand for Affordable Housing in India

The progressive urbanization of Indian society is a primary factor that demands affordable housing. The urban population had increased drastically from 109 million in 1971 to 377 million in 2011. It is assumed to reach 600 million by 2030. This rapid growth in urbanization has caused land and housing shortage, a shortage of essential amenities such as water, power, lung space and so on.

Secondly, due to the rise in income of the middle class, the demand for better housing which is affordable has increased.

Thirdly, real estate is a significant factor behind the growth of the GDP of India. It has contributed to 6.3% of the Indian GDP in the year 2013-2014 which is said to be increased in the coming years.

Impact of Affordable Housing

A city which can provide affordable housing to people can attract wage earners to come and settle in the city. From the economic and national perspective, affordable housing is the indicator of the balanced development of the city as well as the nation.

Affordable housing improves overall wellbeing of any individual and reduces the crime rate and other social disbalances due to a sense of proper settlement and employment stability.

The Framework of An Affordable Housing Scheme in India

The following bodies provide the affordable housing Policy Framework in India:

- NUHHP-2007 – National Urban Housing & Habitat Policy

- JNNURM-2005 – Jawaharlal Nehru National Urban Renewal Mission

- BSUP – Basic Services for the Urban Poor

- IHSDP – Integrated Housing & Slum Development Programme

- Rajiv Awas Yojana

The framework lists some of the essential factors such as land availability, the partnership with the public sector, special provision for women, modernization of housing sector for green energy and cost-effectiveness, disaster management, etc.

The implication of AH at the rural part of India falls under the Ministry of Rural Development, and the housing in urban areas falls under the Ministry of Housing and Urban Poverty Alleviation.

The Inclusion of Private Sector in Affordable Housing

Recently, private sector real estate organizations have included in the development of the affordable housing to accelerate the program. This not only speeds up the process but also, helps in better availability of lands, modernization of the building, availability of microfinance, attracting big financing agencies such as National Housing Bank, NGOs, etc. IFC, an international finance corporation, the investment arm of the World Bank is betting high on affordable housing of India.

Although these agencies are trying to build a better India through affordable housing, many obstacles such as scarcity of land, land acquisition costs, low ROI, slower cash flow, etc. are slowing down the affordable housing process.

Problems with Affordable Housing

Land Scarcity

Rapid urbanization of several parts of India and high population density has created a shortage of proper land that can be developed for the affordable housing policy. Many years of uncontrolled land distribution, increase in the land mafia, illegal encroachments are drastically reducing the availability of affordable land for the builders.

A major part of centrally located urban lands are owned by public entities like defence, railways, ports, etc. and most of these lands are not marketable. Moreover, due to mishaps in controlling these lands, most of these lands are now occupied by slums. These poorly scattered settlements make it difficult for the builders to provide affordable housing. Building AH also requires properly connected and communicated land for the affordability of the project.

Land Registration Issues

Protecting land rights has been a serious problem for the government of India due to the lack of any robust system. Land transactions such as land acquisition, agreement, mortgage, court decrees do not require registration. Moreover, during the sale of any land, the authority is not mandated to verify the history of the land ownership, and this leads to land registration issues while acquiring any and for affordable housing.

Increasing Costs

The costs of land, construction materials, labours everything has increased significantly, and this creates a problem for the builders and Government to produce affordable housing for the mass.

Poor Public-Private Relationship

The poor public-private relationship is another stumbling block for the development of the AH. For example, companies like Mahindra Lifespaces is yet to sign a memorandum with the government for an affordable housing project due to some issues. The Government also must take some quick steps in the PPP front to implement the affordable housing scheme to a larger scale.

Customer’s Difficulties in Getting A Loan

Customers find it difficult to get any sort of loans, especially if they are working in unorganized sectors in India or lack of some income proof. This discourages them to opt for these affordable houses, and due to this lack of interest from the customers, the builders are struggling with regular cash flow to maintain this project at a steady pace.

How to Overcome the Problems of Affordable Housing?

As of now, we have gone through some of the obstacles that the affordable housing scheme face. Now, let us find out what can be some of the probable solutions to these problems.

Clearer Definition

The Government of India mentioned in 2017 that the GST on low-cost housing would be reduced from 12% to 8%. However, the Government did not define the low cos housing properly which still is a matter of confusion for the sellers and buyers. Also, it is mentioned that the GST on affordable housing which has infrastructure status will be reduced, but again they did not define what comes under the “infrastructure status.”

Better Land Availability

The government must take the initiative to provide better land availability for this scheme including the identification of municipal limits. An initiative must be taken to bring more affordable and more accessible lands under this scheme.

Relaxed Norms

The Government should ease the norms like FR and density norms for the better implication of affordable housing. However, they should review the master plan on a regular basis to allow optimum allocation of land for the scheme.

Streamline the Approval Process

There should be a dedicated approval window for affordable housing projects. The building approval process needs to be streamlined as this is a critical factor and consumes a lot of time and also increases the associated costs.

Micro Finance

As mentioned earlier, Indian lower economic class citizens find it very difficult to get loans for home. The process of micro-finance needs to be streamlined and strengthened to allow the lower economical background to access many financial tools to improve their credit history which can eventually improve their chances of getting a loan to afford the affordable housing.

Syncing the Central and State Policies

State level affordable housing policies and the central, affordable housing policies need to have a synchronization to avail central initiative while within the compliance of the state policies.

Advanced Technology and Infrastructure

Only allowing lands will not solve the problem of affordable housing. Proper infrastructure, communication, and social infrastructure to be implemented to make these projects vibrant and habitable. Also, better technology to be implemented in the construction of these buildings to reduce the costs. For example, prefabricated construction technologies, portable housing units, etc. can be taken into consideration.

The Housing for all by 2020 can be a success if all these problems can be demolished and both the public and privet sector work hand in hand. The concept of affordable housing is a holy step to provide the lower and middle economical class citizens with a roof over their heads, but it requires proper planning and implications to reach the goal.