With the increasing democratic population, it has now become difficult to own a house with whatever sum you have. There are so many things to consider when you go for house hunting and most important is the capital. Even if you have enough money, financing a loan is the better option. Why, because giving away a large sum of money in one go is not prudent. Taking a home loan with long tenure is a better option as this will be a less burden on you.

You must be thinking that instead of buying a house why shouldn’t I rent it? Just keep one thing in mind that even if the tenure is long for a home loan and the house will be yours, the rent will keep on going and will increase yearly making a hole in your pocket and this will be difficult if you are not progressing in your business.

Money is an important and necessary part of life and investing it in a better palace will allow you to make a better use of it. A home loan can offer many benefits with a long tenure of payments.

Lower Interest Rates

There are many companies who have lower interest rate schemes where they provide home loans to people who are not able to afford the higher interest rates. As already said longer tenure is preferable as it will be easy for you and with this, you can focus on your business to produce more.

Feeling of Achievement

That feeling of achievement is out of this world when you know that you will be stepping into your own house which you can call your home, soon. One of your biggest financial investments is buying a home and home loans fulfill that achievement. Investing in a house with a large sum of money which is broken into small payable amounts is trouble-free.

Value of Assets

There are chances of fluctuation of properties and the prices can skyrocket but cannot stoop marginal low. Many prospected schemes have been on the floor and construction costs alone have seen a rise of up to 15%, annually. Home loan is one of the investments which can save you from this inflation for a longer period of time.

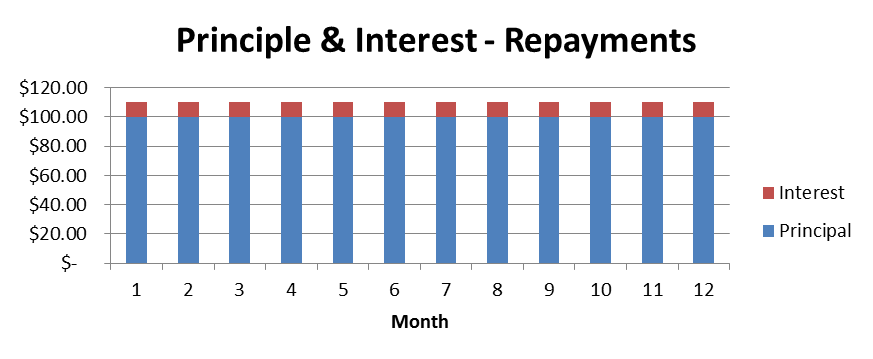

Principle Repayments

Principle repayments enable you to profit conclusions on the installment of the real sum that you’ve acquired. This is under Section 80C of the Income Tax Act. The derivation can’t surpass Rs. 1.5 lakhs. This is joined by insurance premiums, school charges, EPF, NSC, and so forth. It is deducted from your gross aggregate pay. This is particularly profitable if your life partner is a co-candidate in the credit. This is on the grounds that you will be independently qualified for tax benefits. This implies twofold the tax cuts! You can just claim this advantage in case you’re remaining in the house. Leased properties don’t go under the domain of Section 80C.

Interest Payments

Interest Payment allows you an interest deduction on the sum you’ve obtained to buy/build a property. This is under Section 24(b) of the Income Tax Act. This deduction is additionally legitimate for repair and recreation of a current property. This sum has an upper limit of Rs. 2 lakhs. This advantage can be asserted for both private and business property. The preparing expense charged for a loan can be clubbed in this total.

Why Home Loan

Owning a house which you can call your home is a greater achievement as you have the liberty to arrange and redesign it yourself. It’s your home, you can live in it or you can rent it out as per your choice. Home loans are the better option and in fact an investment you will never regret.